Introduction to YSX TECH CO., LTD.

YSX TECH CO., LTD (ticker: YSXT; Korean name: YSX 테크) is a publicly traded provider of electronic manufacturing services (EMS) headquartered in Shenzhen, China. Founded in 2004, the company offers end-to-end solutions that include electronic engineering, PCB fabrication, SMT and PCB assembly, component sourcing, prototyping, box build, and turnkey services. Its clientele encompasses sectors such as telecommunications, consumer electronics, industrial testing and control, medical equipment, power supplies, security systems, and automotive.

Corporate Structure and Experience

Headquartered in Shenzhen, YSX TECH employs between 201 and 500 staff, according to its LinkedIn profile. Since its inception, the company has developed capabilities across multiple value-added services:

- Electronic engineering and design verification

- Printed circuit board (PCB) fabrication and assembly

- Surface-mount technology (SMT) line operations

- Complete box-build and turnkey manufacturing

This integrated model enables YSX TECH to accommodate both small-batch prototyping needs and high-volume production runs for multinational clients.

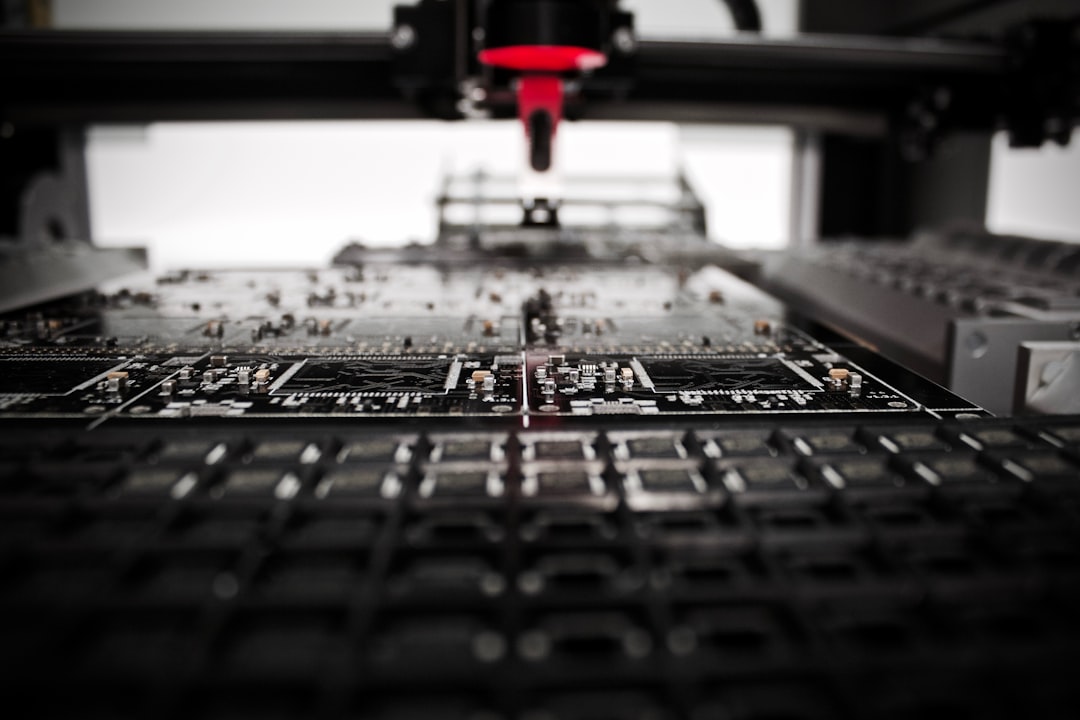

Electronic Manufacturing by Louis Reed

Recent Developments and News

On September 16, 2025, YSXT shares closed at USD 3.80 on the NAS exchange, reflecting a gain of 44.49% on a trading volume of 2,726,672 shares. Key regulatory filings in mid-2025 include:

- Form S-8 (June 13, 2025): Registration of 1,665,000 Class A ordinary shares under the 2025 Equity Incentive Plan aimed at employee compensation.

- Form 6-K (July 31, 2025): Report of foreign issuer, accompanied by a July 31 press release announcing fiscal year 2025 financial results (detailed metrics to be reviewed in the release).

- Form 20-F (July 31, 2025): Annual report for the fiscal year ended March 31, 2025, covering audited financial statements, risk factors, and management discussions.

YSX TECH's official website (http://www.ysx-tech.com/) and Nasdaq’s IPO overview page provide additional corporate and market information.

Financial and Strategic Analysis

The June 13 S-8 filing highlights the company's focus on employee retention through share-based compensation. The 6-K filing indicates that a comprehensive press release regarding FY2025 financials is forthcoming, and detailed metrics will be available upon review of that document.

From a risk perspective, YSX TECH encounters common challenges in the EMS industry, including:

- Competition from global and regional contract manufacturers

- Compliance with regulatory requirements across multiple jurisdictions

- The necessity for ongoing investment in new technologies

Strategically, the company appears to aim at utilizing its turnkey capabilities for market expansion in sectors such as medical devices and automotive electronics, while using equity incentives to enhance talent retention.

Market Position and Industry Context

YSX TECH operates within a competitive EMS landscape. Its comprehensive service offerings—from engineering to box build—position it alongside established providers in the appliances, electrical, and electronics manufacturing sectors. The company’s diversified end-market exposure (telecommunications, industrial, medical, automotive) reduces reliance on any single sector. With 201–500 employees, YSX TECH maintains a mid-sized operational scale, enabling flexibility for both prototyping and volume production.

tl;dr

On September 16, 2025, YSXT shares increased by 44.49% to USD 3.80 amid active trading (over 2.7 million shares). In mid-2025, the company registered 1,665,000 new shares for its Equity Incentive Plan (Form S-8) and filed both Form 6-K and Form 20-F on July 31, 2025. Investors are awaiting detailed FY2025 earnings release and management discussion for insights into revenue trends, margins, and strategic priorities through fiscal 2026.