Introduction to BIOAFFINITY TECHNOLOGIES INC

bioAffinity Technologies Inc (NASDAQ: BIAF) develops noninvasive diagnostics for early-stage lung cancer. Its flagship product, CyPath® Lung, uses flow cytometry and a cancer-selective porphyrin marker to analyze sputum cell populations. In a clinical study of 132 high-risk individuals with lung nodules under 20 mm, the test demonstrated sensitivity, specificity, and a negative predictive value (NPV). CyPath Lung is sold as a laboratory-developed test (LDT) through Precision Pathology Laboratory Services, a bioAffinity subsidiary certified under CLIA.

Corporate Structure and Leadership

Founded in 2014 and headquartered in San Antonio, Texas, bioAffinity employs between 11 and 50 people. Its senior management includes:

- Maria Zannes, President and Chief Executive Officer, with over 30 years of experience in executive management and environmental engineering

- J. Michael Edwards, MBA, CPA, Chief Financial Officer, a certified public accountant with three decades in financial management and biopharmaceutical strategy

- William Bauta, PhD, Chief Science Officer, a medicinal chemist experienced in oncology and metabolic disease therapeutics

- Gordon Downie, MD, PhD, Chief Medical Officer, a pulmonologist specializing in interventional procedures and lung cancer research

- Xavier T. Reveles, MS, CG(ASCP)GM, Chief Operating Officer, an expert in CLIA laboratory development and management

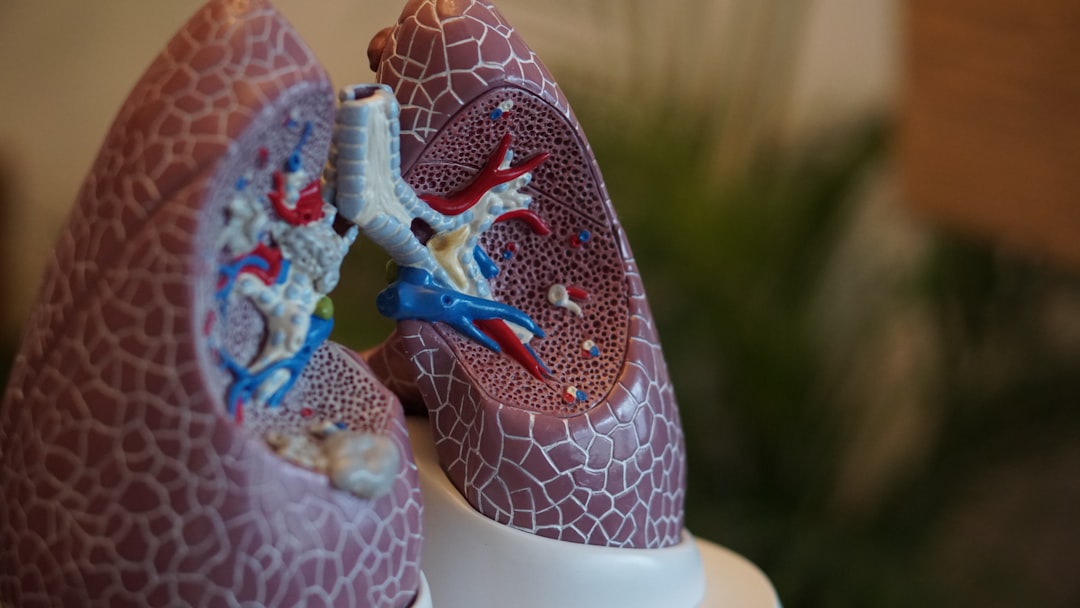

Lung cancer diagnostics by Robina Weermeijer

Recent Developments and News

- In August 2025, U.S. Medicine magazine’s pulmonary issue featured CyPath Lung, highlighting its economic impact and potential benefits for veterans, who are three times more likely than the general population to qualify for lung cancer screening.

- On September 1, 2025, bioAffinity published a case study in which CyPath Lung identified malignancy in a ground-glass nodule that had remained indeterminate under imaging alone, demonstrating its sensitivity and specificity for nodules under 20 mm.

- On September 17, 2025, shares of BIAF traded 7,548,199 shares on NASDAQ at $0.1877, a 28.08% decrease from the prior close.

Financial and Strategic Analysis

bioAffinity’s LDT business model leverages existing laboratory infrastructure to generate revenue without the capital expenditure associated with device manufacturing. The company’s CLIA certification enables high-complexity testing at Precision Pathology Laboratory Services. Chief Financial Officer J. Michael Edwards has outlined a strategic plan to support the commercialization of CyPath Lung through partnerships with physicians and reimbursement initiatives. Cash flow for the company is closely tied to test adoption rates and insurance coverage for noninvasive diagnostics. The recent 28.08% decline in share price on September 17, 2025, may indicate market uncertainty regarding revenue growth and competitive dynamics.

Market Position and Industry Context

In the U.S., low-dose computed tomography (LDCT) is the standard lung cancer screening tool but carries a low positive predictive value, which can result in unnecessary invasive procedures. CyPath Lung aims to enhance traditional imaging by adding cellular-level analysis of sputum samples. The global market for lung cancer diagnostics is expanding as screening guidelines evolve. bioAffinity’s application of flow cytometry and porphyrin-based markers positions it alongside other liquid biopsy and molecular diagnostic firms. The successful adoption of CyPath Lung will depend on continued clinical validation, payer coverage, and integration into pulmonology practice.

TL;DR

As of September 17, 2025, bioAffinity shares declined by 28.08% to $0.1877 on NASDAQ, with 7.5 million shares traded. In August 2025, U.S. Medicine featured CyPath Lung’s economic implications for veterans. On September 1, 2025, a case study illustrated the test’s sensitivity and specificity for nodules under 20 mm. Management is advancing commercialization through partnerships with physicians and reimbursement strategies. Future considerations include broader payer coverage, additional clinical validation data, and the potential for expanding non-lung diagnostics and porphyrin-based therapeutics.