Introduction

QUALIGEN THERAPEUTICS INC (Nasdaq: QLGN) is a clinical-stage therapeutics company headquartered in Carlsbad, California. The firm is focused on developing treatments for adult and pediatric cancers, with three investigational oncology programs: QN-302, a small-molecule transcription inhibitor targeting G4 DNA structures; Pan-RAS protein-protein interaction inhibitors; and QN-247.

Corporate Structure and Experience

As of September 2025, QUALIGEN employs between 11 and 50 staff members. The company operates in the biotechnology research industry and maintains a public listing on Nasdaq. Kevin A. Richardson II serves as Interim Chief Executive Officer and Interim Chief Financial Officer. QUALIGEN is pursuing Orphan Drug Designation for selected oncology indications.

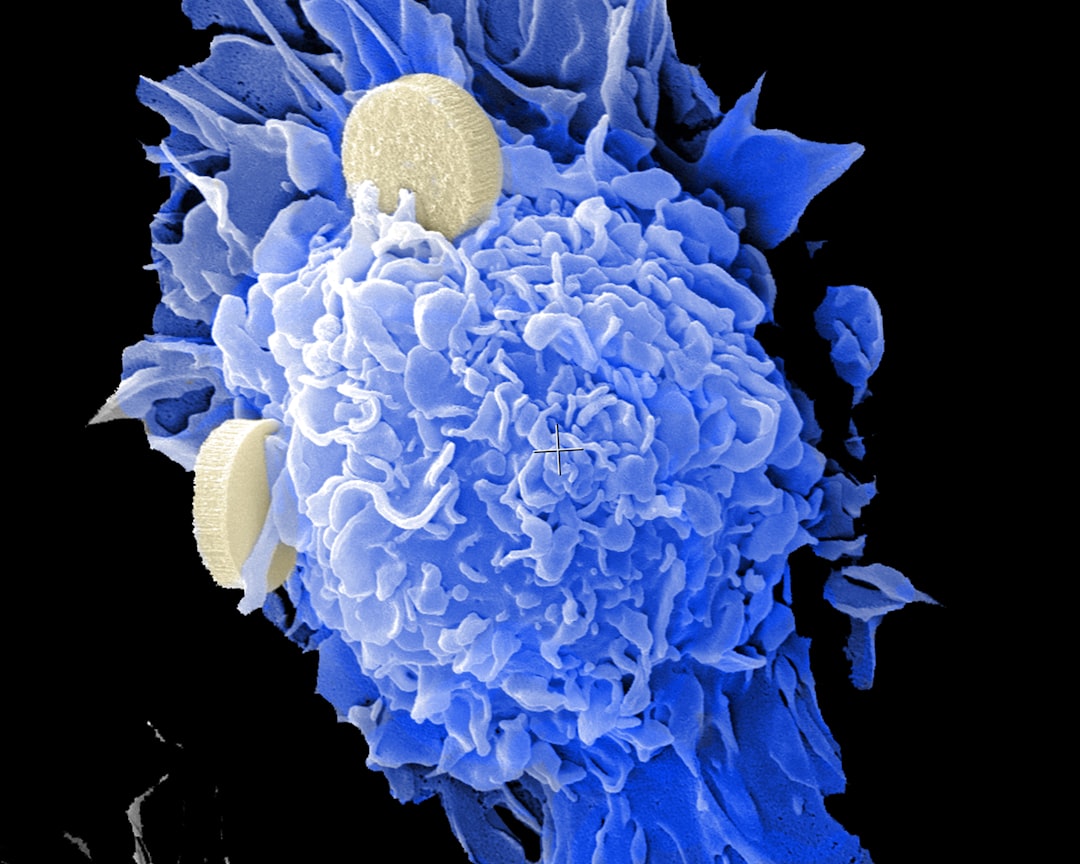

Oncology Therapeutics by National Cancer Institute

Recent Developments and News

On September 17, 2025, QUALIGEN’s stock price increased by 26.99%, closing at $2.54 with a trading volume of 242,988 shares on the Nasdaq exchange. Key filings in mid-September 2025 included:

- Form S-1 registration statement filed on September 16, 2025 (Acc-No. 0001493152-25-013721) under the Securities Act of 1933.

- Form 8-K filed on September 16, 2025, reporting material events under Items 1.01, 2.03, and 9.01.

- Form 8-K filed on September 8, 2025 (Item 3.01), addressing a change in shell status.

In July 2023, the company sold its FastPack® diagnostics business to Chembio Diagnostics, Inc., a U.S. subsidiary of BIOSYNEX Group.

Financial and Strategic Analysis

QUALIGEN’s market capitalization is approximately $3.39 million. For the quarter ended June 30, 2025, the company reported a net loss of $1.69 million, compared to a net loss of $3.49 million in Q2 2024, indicating a reduction of approximately 51.94%. Basic and diluted earnings per share were negative $1.00 for Q2 2025, compared to negative $1.83 in the same quarter of the previous year, reflecting an improvement of approximately 86.32%. The details within the Form S-1 will provide additional insights into liquidity and capital requirements. QUALIGEN is pursuing partnerships for licensing opportunities in its QN-302 and Pan-RAS programs.

Market Position and Industry Context

QUALIGEN trades below its 200-day simple moving average and is positioned near the lower bound of its 52-week range. Operating within the small-cap oncology therapeutics segment, the company faces competition from established biopharmaceutical firms and emerging biotech ventures. Its focus on rare cancers and orphan-drug pathways positions its pipeline candidates—specifically QN-302 and Pan-RAS inhibitors—within areas of high unmet medical need, including pancreatic, colorectal, and lung cancers.

tl;dr

On September 17, 2025, QLGN shares rose 26.99% to $2.54 following Form S-1 and Form 8-K filings on September 16, 2025. Q2 2025 results showed a 51.94% reduction in net loss year-over-year and an 86.32% improvement in EPS. Pipeline programs QN-302 and Pan-RAS are in active development, with licensing discussions ongoing and potential Orphan Drug Designation for select oncology indications. Future developments may include clinical trial results and partnership agreements.