Introduction

REPLIMUNE GROUP INC (NASDAQ: REPL) is a clinical-stage biotechnology company headquartered in Woburn, Massachusetts, with a manufacturing facility in Framingham, Massachusetts. Founded in 2015, the company develops oncolytic immunotherapies designed to elicit systemic anti-tumor immune responses. Its lead candidate, RP1 (vusolimogene oderparepvec), is being evaluated across multiple solid tumor types, both as a monotherapy and in combination with immune checkpoint inhibitors.

Corporate Structure

Replimune employs research scientists, clinical development specialists, and manufacturing personnel across its two Massachusetts sites. While the exact headcount is not publicly disclosed, the company’s LinkedIn presence emphasizes recruitment of talent with experience in virology, oncology, and bioprocessing. Strategic collaborations—such as its supply agreement with Bristol-Myers Squibb for nivolumab—support both clinical development and potential commercialization.

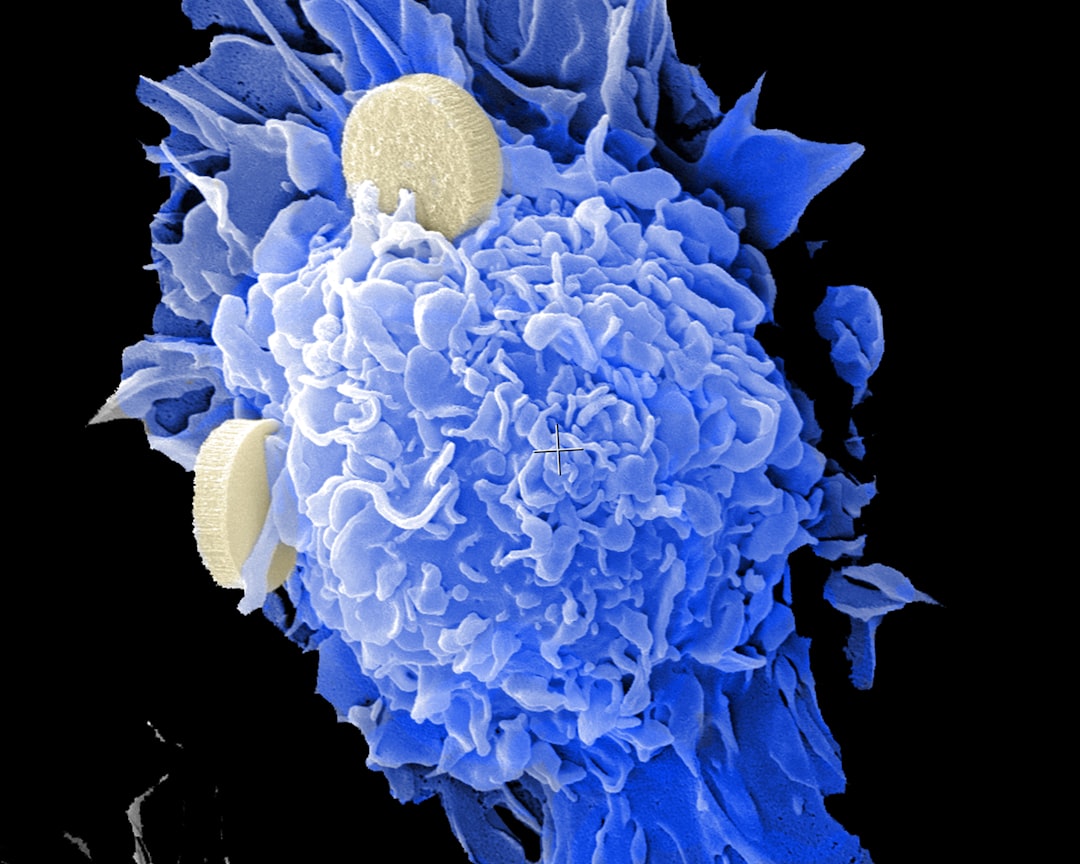

Oncolytic immunotherapy by National Cancer Institute

Recent Developments and News

On July 22, 2025, the U.S. Food and Drug Administration issued a Complete Response Letter for the Biologics License Application of RP1, citing the IGNYTE trial as “inadequate and not well-controlled,” thereby delaying approval. Enrollment for the IGNYTE-13 confirmatory trial in advanced melanoma is currently underway, while a cohort studying RP1 + nivolumab in non-melanoma skin cancers (including anti-PD-1 failures) continues to recruit. The ARTACUS trial, which examines RP1 monotherapy in post-transplant skin cancer patients, remains active.

On September 4, 2025, and September 18, 2025, Replimune filed Current Reports on Form 8-K, disclosing operational updates and the FDA’s Complete Response Letter, respectively. A class action lawsuit (Jboor v. Replimune Group, Inc.) was filed in the U.S. District Court for the District of Massachusetts, alleging that the company overstated IGNYTE prospects during the period from November 22, 2024, through July 21, 2025.

Financial and Strategic Analysis

On September 18, 2025, REPL closed at $3.29, down 42.38% on a volume of 10,305,797 shares. Intraday market capitalization stood at approximately $267.3 million. As of June 30, 2025, the company reported cash and equivalents of $403.3 million and a total debt-to-equity ratio of 22.7%. Over the trailing twelve months, Replimune recorded a net loss of $280.2 million and a levered free cash flow of –$130.5 million.

Replimune retains full commercial rights to RP1 and has structured collaborations—most notably with Bristol-Myers Squibb—to supply nivolumab while retaining long-term royalty interests. Its Immulytic™ platform delivers immune-activating transgenes within an oncolytic virus backbone, positioning RP1 for combination regimens with other immunotherapies.

| Metric | Value |

|---|---|

| Stock price (Sep 18, 2025) | $3.29 |

| Day’s change | –42.38% |

| Volume | 10,305,797 |

| Market cap (intraday) | $267.3 million |

| 52-Week range | $2.68 – $17.00 |

| Cash and equivalents (Jun 30, 2025) | $403.3 million |

| Total debt/equity (mrq) | 22.7% |

Market Position and Industry Context

Oncolytic immunotherapy represents a niche within the broader immuno-oncology segment. Replimune’s approach builds on the clinical validation of first-generation oncolytic agents by encoding additional immune-stimulatory proteins. Competitors include companies developing viral vectors, cell therapies, or bispecific antibodies, but few have combined viral oncolysis with transgene-mediated immune modulation. The upcoming IGNYTE-13 readout and ARTACUS data are key catalysts that may inform RP1’s positioning against alternative modalities.

tl;dr

On July 22, 2025, the FDA issued a Complete Response Letter for RP1’s BLA, delaying approval after citing the IGNYTE trial as “inadequate.” REPL shares declined 42.38% to $3.29 on September 18, 2025. Enrollment continues in the IGNYTE-13 confirmatory trial and cohorts for non-melanoma skin cancers, with a PDUFA date yet to be reset. Cash reserves of $403 million are expected to support operations through mid-2026, pending key clinical readouts and regulatory discussions.