Introduction

Monolithic Power Systems, Inc. (NASDAQ: MPWR) designs, develops, and markets integrated power semiconductor solutions. Headquartered in Kirkland, Washington, the company serves communications, cloud computing, telecom, automotive, industrial, and consumer markets. Since its founding in 1997 by Michael R. Hsing, Monolithic Power Systems has expanded to operate 18 locations worldwide and offers over 4,000 products across 13 product lines.

Corporate Structure and Workforce

Monolithic Power Systems operates through regional offices and support centers in North America, Europe, and East Asia. According to public filings, the company employs between 1,001 and 5,000 staff, including analog and digital design engineers, applications specialists, and global sales teams. Michael R. Hsing remains Chief Executive Officer. In February 2023, the board of directors added a second female director as part of its governance and diversity objectives.

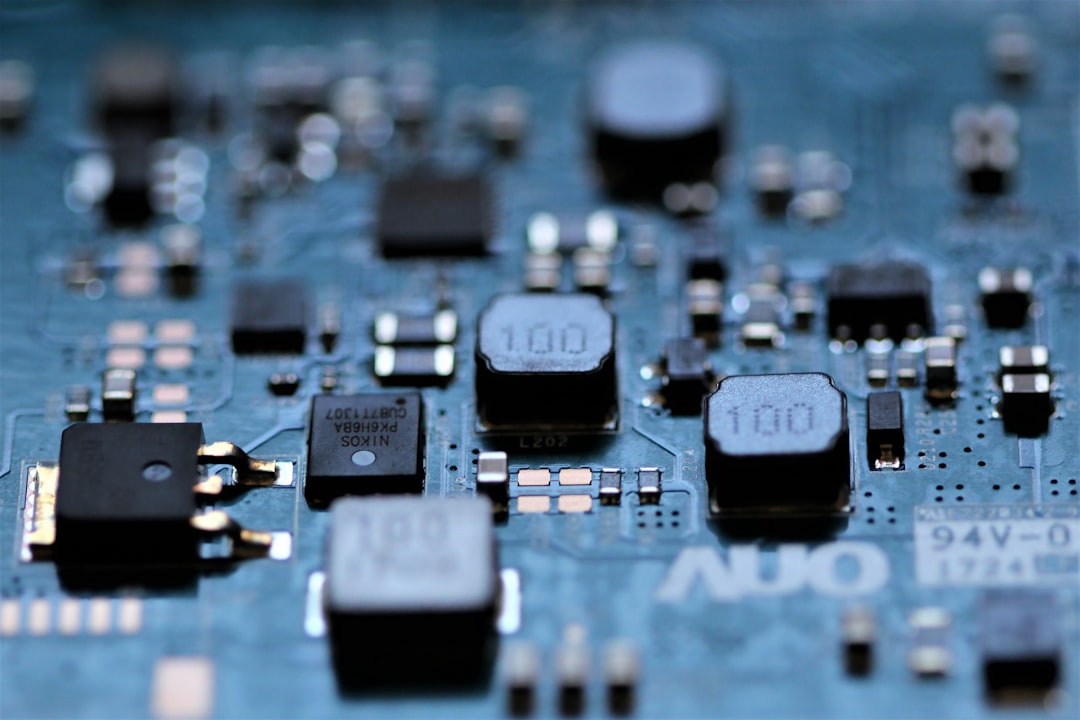

Power Semiconductors by Anne Nygård

Developments and News

On February 8, 2021, S&P Dow Jones Indices announced that Monolithic Power Systems would join the S&P 500 effective February 12, 2021. In 2023, the company published its annual ESG report and committed to reducing Scope 1 and 2 greenhouse gas emissions by 40% by 2030 and sourcing 75% of its global electricity from renewable sources by 2026.

In 2025, Monolithic Power Systems participated in Electronica India 2025, showcasing power modules, battery management systems, and sensors for data-center, automotive, and industrial applications.

Financial and Strategic Analysis

As of September 24, 2025, MPWR shares closed at USD 908.83, down 0.60% on the day. Trading volume reached 102,357 shares versus an average daily volume of 29 shares, indicating a substantial increase in trading activity. This elevated volume may suggest increased investor interest, possibly influenced by recent event participation and sustainability disclosures. Monolithic Power Systems derives revenue from a diversified portfolio of power conversion and control ICs, which support cloud infrastructure, electrification of transportation, and consumer electronics. Its addition to the S&P 500 in 2021 has been noted as a factor supporting institutional demand for the company’s stock.

Market Position and Industry Context

Monolithic Power Systems competes in the specialized semiconductor segment, focusing on energy-efficient DC/DC converters, lighting-control ICs, and mixed-signal power management. Key competitors include other analog and power-management IC suppliers targeting data centers, automotive, and industrial automation markets. The global emphasis on electrification and energy efficiency has increased demand for compact, high-conversion-efficiency power solutions. Monolithic’s global distribution network and in-house design capabilities position it to serve original equipment manufacturers, design houses, and electronic manufacturing services across Asia, Europe, and North America.

tl;dr

MPWR shares traded at USD 908.83 on September 24, 2025, down 0.60% with volume increasing to 102,357. The company reaffirmed its ESG targets—40% reduction in Scope 1 and 2 emissions by 2030 and 75% renewable electricity by 2026—and showcased new product demonstrations at Electronica India 2025. Its inclusion in the S&P 500 since February 2021 continues to support institutional demand. The future outlook focuses on sustaining growth across cloud, automotive electrification, and industrial automation markets while meeting sustainability milestones.