Introduction

bioAffinity Technologies, Inc. (NASDAQ: BIAF) develops noninvasive diagnostics aimed at detecting early-stage lung cancer. Founded in 2014 and headquartered in San Antonio, Texas, the company markets its first product, CyPath® Lung, as a laboratory-developed test (LDT) through Precision Pathology Laboratory Services. By analyzing sputum with flow cytometry and proprietary biomarkers, CyPath® Lung provides a reported sensitivity of approximately 92 percent and specificity of around 87 percent in high-risk individuals with pulmonary nodules under 20 mm.

Corporate Structure

As of September 26, 2025, bioAffinity employs between 11 and 50 staff members across scientific, clinical, and administrative functions. The management team is led by President and CEO Maria Zannes, who has over 30 years of executive leadership experience, including a background in strategic solutions for the medical and environmental sectors. J. Michael Edwards, MBA, CPA, serves as Chief Financial Officer, overseeing long-term financial strategy and commercialization efforts. William Bauta, PhD, acts as Chief Science Officer, guiding research and development in diagnostics and therapeutic initiatives.

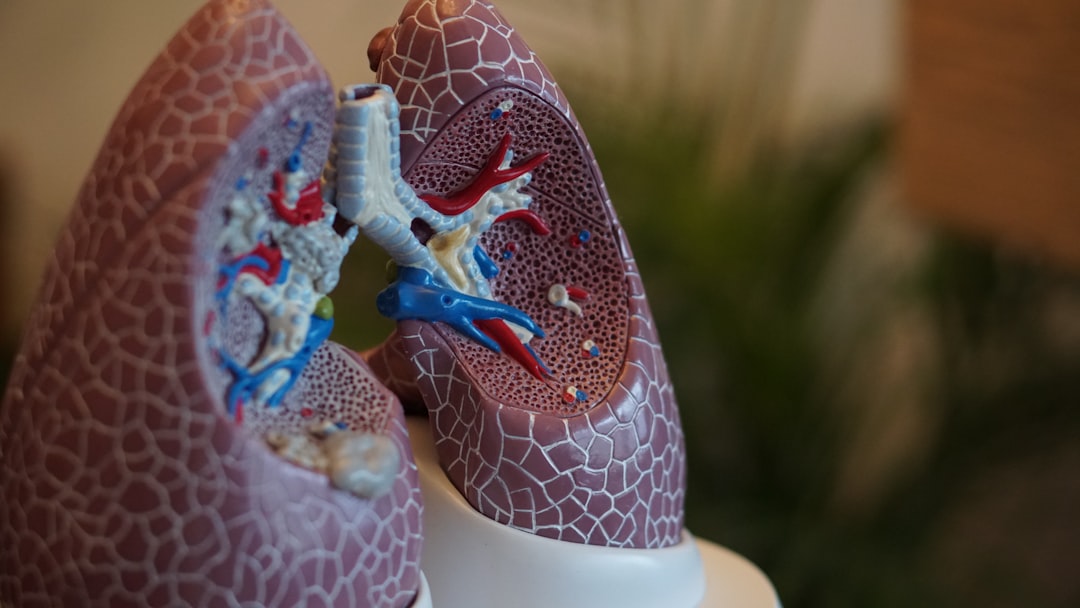

Lung cancer diagnostics by Robina Weermeijer

Recent Developments and News

- On September 18, 2025, the company filed a Form 424B3 prospectus registering the resale of 32,495,628 shares of common stock, noting that bioAffinity will receive proceeds only from warrant exercises. The filing discussed a private placement in August 2025 that involved the exercise of 6,714,780 warrants and the issuance of 1,430,000 inducement warrants, with an anti-dilution provision affecting an additional 19,884,375 shares.

- On September 24, 2025, bioAffinity submitted its initial S-1 registration statement under the Securities Act of 1933, indicating a formal step toward public offerings.

- On September 25, 2025, the company submitted Amendment No. 1 to the S-1 filing, confirming its status as an emerging growth company and smaller reporting company.

- As of market close on September 26, 2025, the share price stood at $6.2088—a reported increase of 82.08 percent—on trading volume of 12,707,458 shares.

Financial and Strategic Analysis

bioAffinity has not yet released full financial statements in its public filings; however, through its S-1 and related amendments, the company has indicated a phased securities offering strategy “from time to time” following the effective date. Proceeds from warrant exercises are intended to support working capital and ongoing commercialization of CyPath® Lung. The classification as an emerging growth company allows bioAffinity to adhere to reduced reporting requirements. The Form 424B3 activity highlights efforts to manage capital structure and mitigate dilution through private placements and inducement warrants.

Market Position and Industry Context

Lung cancer remains a leading cause of cancer-related deaths worldwide. Current screening protocols typically rely on low-dose computed tomography (LDCT), which is associated with low positive predictive value and may lead to unnecessary invasive follow-up procedures. CyPath® Lung presents an alternative by offering a noninvasive solution for patients with indeterminate nodules, which may reduce unnecessary biopsies, lower patient anxiety, and potentially decrease healthcare costs. In the diagnostic landscape, bioAffinity competes with imaging providers and emerging liquid-biopsy platforms, positioning its flow-cytometry-based assay as a complementary tool in multidisciplinary lung cancer care.

tl;dr

Shares of bioAffinity Technologies increased by 82.08 percent to $6.2088 on September 26, 2025, following a set of SEC filings: a Form 424B3 prospectus on September 18, an S-1 registration on September 24, and an amended S-1 on September 25. The company plans phased offerings to fund the commercialization of CyPath® Lung, its CLIA-certified test for early lung cancer detection. Investors will monitor the effective date of the registration statement and warrant exercises in Q4 2025 as indicators of capital availability and the company’s market penetration efforts.