Introduction

SCYNEXIS, Inc. (NASDAQ: SCYX), known in Korea as 사이넥시스, is a biotechnology company based in Jersey City, New Jersey. Founded in 2000, SCYNEXIS focuses on developing a class of antifungal agents known as “fungerps” to address drug-resistant fungal infections.

Corporate Structure and Experience

SCYNEXIS operates with a team of 11–50 employees, leveraging over two decades of experience in anti-infective drug discovery and development. The leadership and scientific staff have contributed to the discovery or development of more than 30 medicines across various therapeutic areas.

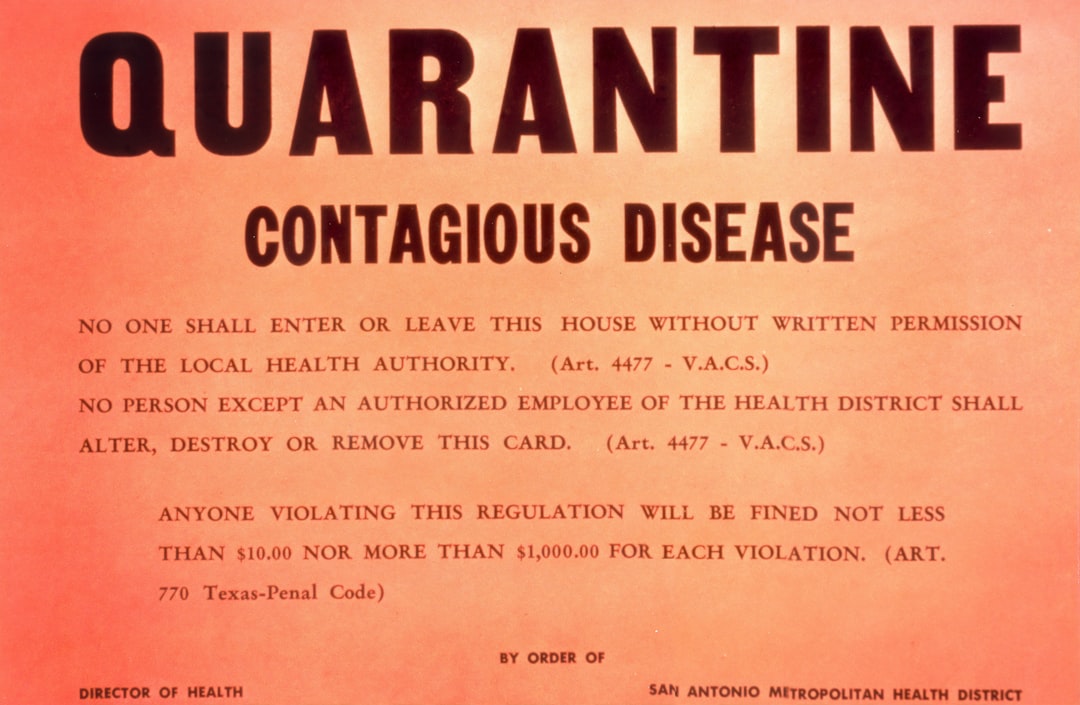

Antifungal agents by CDC

Recent Developments and News

On May 28, 2025, SCYNEXIS announced the resumption of patient dosing in its Phase 3 MARIO study of oral ibrexafungerp for invasive candidiasis, following the lifting of a clinical hold imposed by the FDA. This milestone is associated with a $10 million payment from partner GSK, with an additional $20 million owed six months after patient dosing; however, GSK has raised disputes regarding these milestone payments.

On November 6, 2024, the company reported its third-quarter 2024 financial results, which included the following points:

- Delivery of the final study reports for the FURI, CARES, and NATURE trials triggered a $10 million milestone payment from GSK, received in Q3.

- SCYNEXIS ended September 30, 2024, with $84.9 million in cash, cash equivalents, and investments, projecting a cash runway into Q3 2026.

- Preclinical data for SCY-247, the next-generation fungicide, were presented at scientific meetings, supporting a planned Phase 1 initiation in Q4 2024.

Financial and Strategic Analysis

As of market close on September 30, 2025, SCYX shares traded on NASDAQ at $0.7832, down 25.41% on a volume of 1,210,850 shares. This decline reflects market sensitivity related to cash needs and ongoing partner negotiations.

License revenue in Q3 2024 amounted to $0.7 million, down from $2.4 million a year earlier, while research and development expenses rose 25% to $8.1 million, attributed to increased costs in chemistry, manufacturing, and controls (CMC) and preclinical program expansion. The cash position of $84.9 million supports ongoing research and development initiatives, particularly the manufacturing scale-up for the MARIO study and the SCY-247 Phase 1 trial through at least mid-2026.

Market Position and Industry Context

Health authorities have reported concerns regarding the increasing antifungal resistance crisis, specifically with invasive candidiasis and aspergillosis, which lack effective oral step-down therapies. Currently, echinocandins remain the IV standard of care, with no approved oral non-azole alternatives available. SCYNEXIS’s ibrexafungerp is positioned to address this gap. The partnership with GSK focuses on the commercial development of BREXAFEMME® (vulvovaginal candidiasis) and ibrexafungerp in most global markets, highlighting the strategic importance of these programs. Additionally, the SCY-247 program represents a long-term commitment to developing broad-spectrum antifungal therapies.

tl;dr

On May 28, 2025, SCYNEXIS resumed patient enrollment in its Phase 3 MARIO trial of oral ibrexafungerp, generating a contested $10 million milestone from GSK with a further $20 million payment due in November 2025. The company closed Q3 2024 with $84.9 million in cash, facilitating ongoing trial manufacturing and the upcoming SCY-247 Phase 1 study. The resolution of disputes with GSK and the six-month anniversary of MARIO will influence near-term liquidity and clinical progress.