Introduction

American Resources Corporation (NASDAQ: AREC) is a raw-materials solutions provider headquartered in Fishers, Indiana. Founded in 2006, the company specializes in supplying rare earth and critical mineral concentrates for applications in industries such as rare-earth magnets, lithium-ion batteries, and semiconductors. Operations include processing mining waste streams, investments in various mines and recyclers, and proprietary purification technology.

Corporate Structure and Experience

American Resources employs between 201 and 500 staff at its headquarters and production facilities in eastern Kentucky and West Virginia. Mark C. Jensen serves as Chief Executive Officer and Chairman of the Board, while Mark J. Laverghetta leads corporate finance and communications. The company operates three primary segments:

- American Infrastructure (AIC): Extraction and distribution of metallurgical-quality coal for the steel industry.

- ReElements (RLMT): Final-stage separation and purification of rare earth and critical elements for the electrification supply chain.

- Electrified Materials Corporation (EMC): Aggregation and recycling of ferrous metals into new steel-based products.

Since 2015, management has focused on a low-capital-expenditure model, integrating eight asset acquisitions and over fifteen intellectual-property and technology partnerships to modernize mining operations.

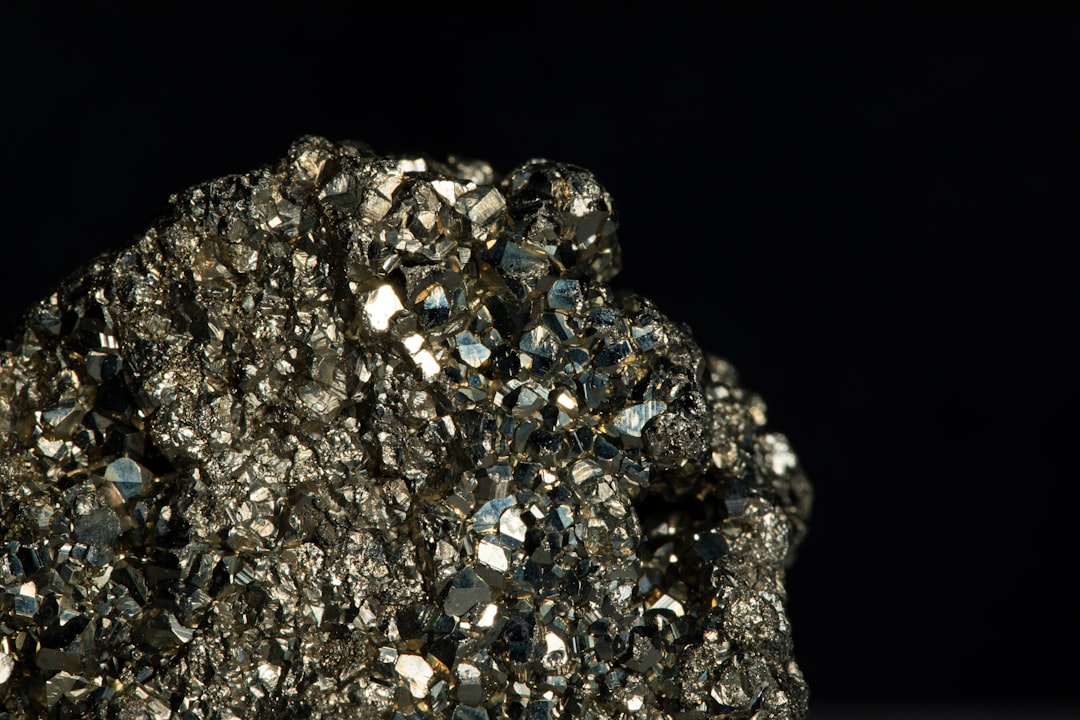

Critical minerals by Calvin Chai

Recent Developments and News

As of October 14, 2023, AREC shares closed at $6.69 on the NASDAQ, reflecting a 34.34% gain on a volume of 14,603,549 shares traded. In its 2024 Annual Report and Form 10-K, filed in March 2023, the company outlined plans to launch its “Capture • Process • Purify” rare earth technology chain by the end of Q1 2024. Management is also conducting due diligence on multiple potential acquisitions aimed at increasing the production of critical mineral concentrates.

Financial and Strategic Analysis

AREC’s recent share-price increase indicates growing investor interest in domestic critical minerals supply. The firm’s low-operating-cost model aims to minimize capital intensity, while its diversified segment structure provides a buffer against commodity price fluctuations. Currently, the company does not pay a cash dividend; however, its long-term strategy emphasizes both organic growth and efficient turnaround projects. Management seeks returns through technology licensing, asset commercialization, and selective acquisitions.

Market Position and Industry Context

American Resources occupies a niche within the U.S. critical-materials sector, supplying inputs for defense and commercial electrification markets. By concentrating on metallurgical carbon, rare earth oxides, and recycled steel, AREC aligns with federal initiatives to strengthen domestic supply chains and reduce reliance on imports. The company’s footprint in the Permian-to-Appalachian region, coupled with proprietary purification processes, positions it competitively against both domestic and international miners.

tl;dr

On October 14, 2023, AREC shares increased by 34.34% to $6.69 amid heavy trading. The company plans to operationalize its Capture • Process • Purify rare-earth purification line in Q1 2024 and is advancing multiple acquisition targets to enhance critical mineral output.