Introduction

Artiva Biotherapeutics Inc. (NASDAQ: ARTV) is a clinical-stage biotechnology company based in San Diego, California, focused on developing off-the-shelf, allogeneic natural killer (NK) cell therapies for autoimmune diseases and cancer. The company's lead candidate, AlloNK®, is a cryopreserved, non-genetically modified NK cell therapy being evaluated in combination with B-cell–targeted monoclonal antibodies.

Corporate Overview

Founded in 2019, Artiva employs between 51 and 200 professionals across research, clinical development, manufacturing, and corporate functions. Its executive leadership is headed by President and CEO Fred Aslan, M.D., with a board of directors and scientific advisors experienced in cell therapy. The organization promotes transparency and inclusion in its operations.

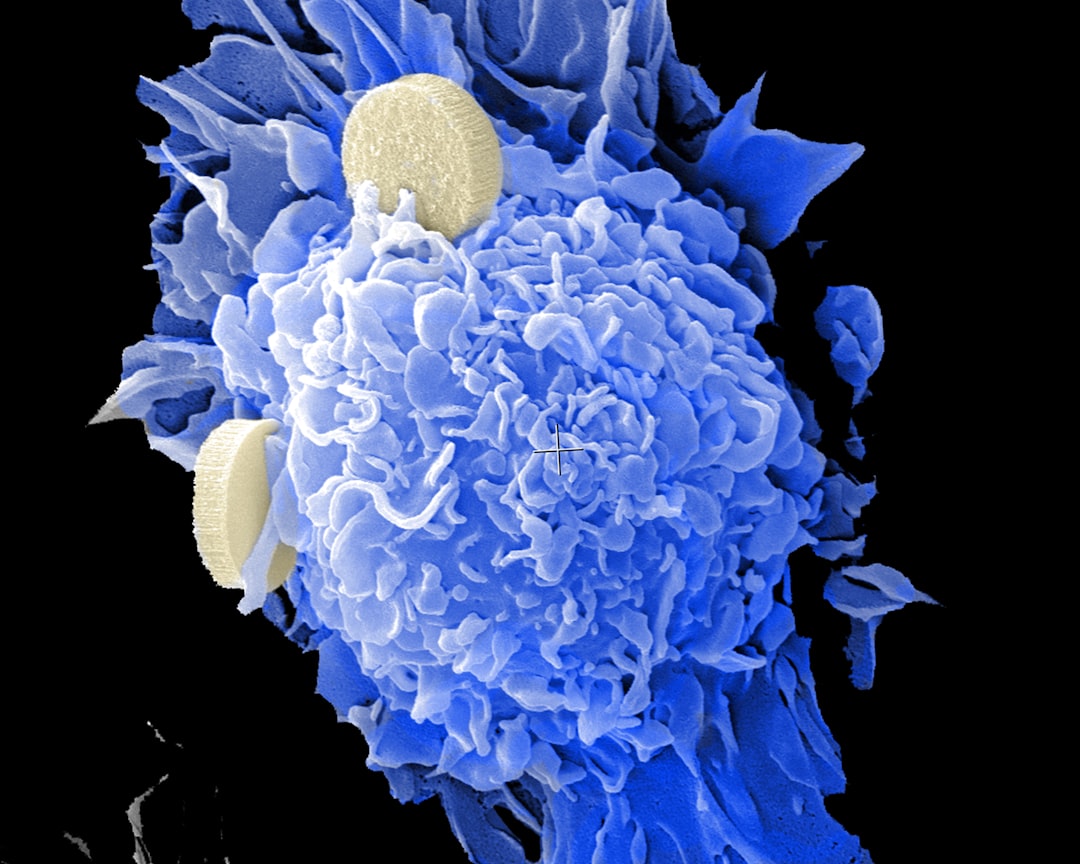

NK cell therapy by National Cancer Institute

Developments and News

- May 2025: The U.S. Food and Drug Administration (FDA) cleared Artiva’s Investigational New Drug application (IND) to initiate an open-label Phase 2a basket trial (ClinicalTrials.gov Identifier: NCT06991114). This study evaluates AlloNK® in combination with rituximab for refractory rheumatoid arthritis, Sjögren’s disease, idiopathic inflammatory myopathies, and systemic sclerosis.

- August 2025: The first patient was treated in the company-sponsored Phase 2a basket trial.

- August 15, 2025: The SEC declared effective Artiva’s S-3 registration statement (Form 333-289325), enabling capital raises.

- October 2025: AlloNK® received Fast Track designation from the FDA for refractory rheumatoid arthritis in combination with rituximab.

- Mid-November 2025: Translational and safety data are expected to demonstrate the therapy’s B-cell depletion profile in outpatient settings.

- First half of 2026: Clinical response data from more than 15 refractory rheumatoid arthritis patients are anticipated.

Financial and Strategic Analysis

As of October 17, 2025, Artiva’s share price was $5.64, reflecting a 103.60 percent increase from the previous session, on a volume of 10,387,204 shares (52-week average: 408,303). The company’s market capitalization is approximately $72 million. For the trailing twelve months, Artiva reported a net loss of $75.13 million and a diluted EPS of –$6.15. Total cash on hand was $142.36 million, with debt equating to 8.87 percent of equity. The effective S-3 registration facilitates access to public capital markets, supporting ongoing trials and pipeline expansion.

Market Position and Industry Context

Over the past decade, cell therapies—particularly autologous CAR-T—have achieved responses in hematologic malignancies but have been limited by toxicities, high costs, and complex manufacturing. Artiva’s AlloNK® platform aims to address these challenges by providing a cryopreserved NK cell therapy designed for outpatient use alongside established monoclonal antibodies. The FDA’s Fast Track designation for refractory rheumatoid arthritis indicates regulatory acknowledgment of this mechanism’s potential in deep B-cell depletion for an autoimmune indication. Artiva competes with other developers of allogeneic NK cells and NK-cell engagers, positioning itself within the growing market for accessible cell-based immunotherapies.

tl;dr

Shares of Artiva Biotherapeutics rose 103.60 percent to $5.64 on October 17, 2025, following FDA Fast Track designation for AlloNK® in refractory rheumatoid arthritis. Phase 2a dosing began in August 2025, with IND clearance in May 2025 and SEC S-3 effectiveness on August 15, 2025. Translational and safety data will be released in mid-November 2025, and clinical response results are expected in the first half of 2026.