Introduction

Replimune Group Inc (NASDAQ: REPL) is a clinical-stage biotechnology company headquartered in Woburn, Massachusetts. Founded in 2015, Replimune focuses on developing oncolytic immunotherapies designed to trigger a systemic, tumor-specific immune response. The company aims to advance a new class of treatments that may address multiple tumor types.

Corporate Structure and Leadership

Replimune employs between 201 and 500 professionals across research, development, manufacturing, and corporate functions. Its leadership team includes expertise in oncology, immunology, and commercial strategy.

• Sushil Patel serves as Chief Executive Officer, overseeing clinical programs and strategic partnerships.

• Kostas Xynos holds a key executive role in financial planning and operations.

The board and advisory panels comprise clinicians and scientists who guide the company’s clinical trial design and regulatory interactions.

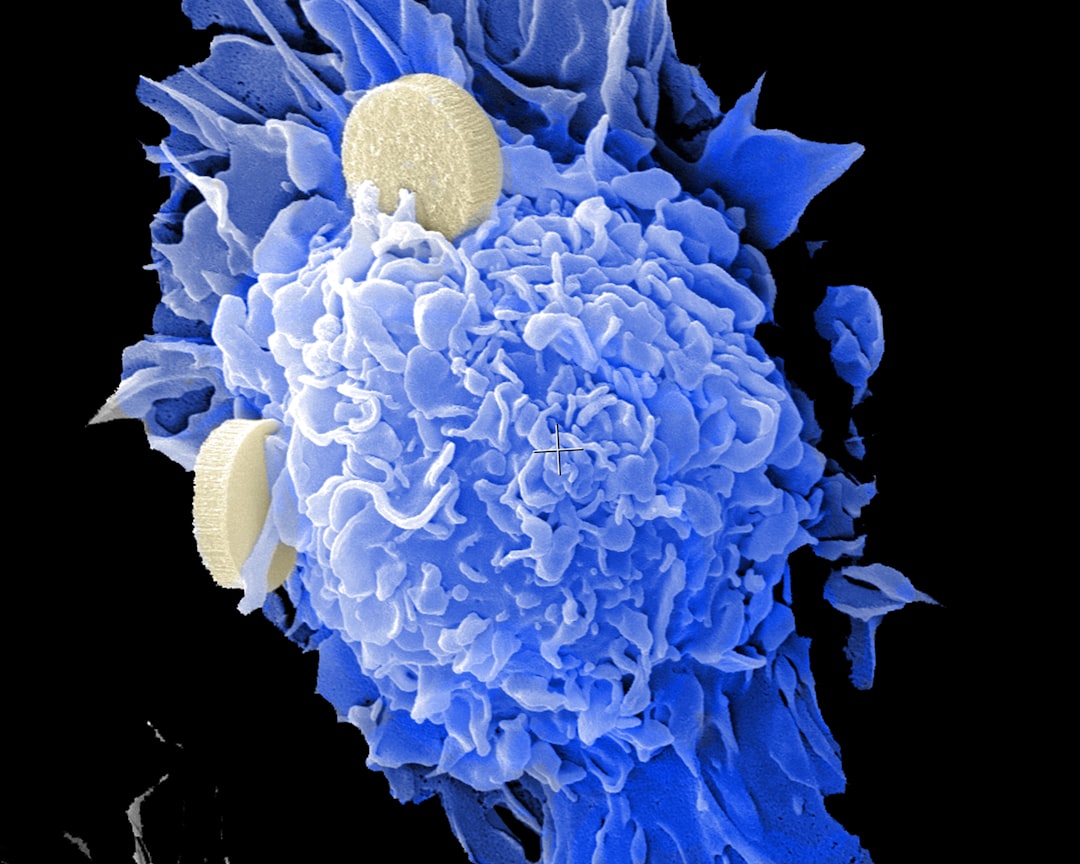

Oncolytic immunotherapy by National Cancer Institute

Recent Developments and News

On October 20, 2025, Replimune’s shares closed at $9.50, reflecting a 111.11% increase on a volume of 23.98 million shares. Key milestones and events include:

- The U.S. Food and Drug Administration accepted the Biologics License Application for RP1, initiating the review process for the lead oncolytic candidate.

- The Prescription Drug User Fee Act (PDUFA) deadline for the RP1 + nivolumab combination in advanced melanoma is set for July 22, 2025.

- The IGNYTE-13 confirmatory trial in advanced melanoma is currently enrolling, alongside cohorts evaluating RP1 plus nivolumab in non-melanoma skin cancers and an organ-transplant patient monotherapy study (ARTACUS).

- A Type A meeting with the FDA concluded earlier this year, resulting in a complete response letter and leading to a series of class action lawsuits alleging incomplete disclosure of trial data.

Financial and Strategic Analysis

As of mid-October 2025, Replimune’s market capitalization stood at approximately $363 million. The company reported $403 million in cash and cash equivalents for the most recent quarter, with a debt-to-equity ratio of 22.7%. Trailing twelve-month net losses amounted to $280 million, with diluted EPS of –$3.24 and a price-to-book ratio of 1.08.

Strategically, Replimune retains full commercial rights to RP1 despite a clinical collaboration and supply agreement with Bristol-Myers Squibb for nivolumab. This structure allows the company to benefit from late-stage trial support while preserving its long-term revenue potential. The balance sheet suggests a financial runway extending through pivotal data readouts and regulatory decisions.

Market Position and Industry Context

Replimune operates in the oncolytic immunotherapy niche within the broader immuno-oncology sector. Its platform seeks to enhance existing checkpoint inhibitors by delivering a viral-based agent that directly lyses tumor cells and primes systemic immunity. Competitors include other biotech firms developing viral therapies and large pharmaceutical companies with broad immuno-oncology franchises. Partnerships with leading academic centers and participation at major conferences such as ASCO strengthen Replimune’s scientific network. Valuation metrics indicate the company trades below peer averages in price-to-book and enterprise value ratios, reflecting both the uncertainty of clinical endpoints and the potential upside of its pipeline.

tl;dr

On October 20, 2025, REPL shares rose 111% to $9.50 following the FDA's acceptance of the RP1 BLA and anticipation of the July 22, 2025 PDUFA date for RP1 + nivolumab in advanced melanoma. Enrollment is underway in confirmatory and non-melanoma cohorts, while ARTACUS investigates monotherapy in transplant patients. A prior FDA complete response letter and related lawsuits impact share volatility, while cash reserves support the company’s outlook through pivotal data milestones.