Stock Performance on January 7

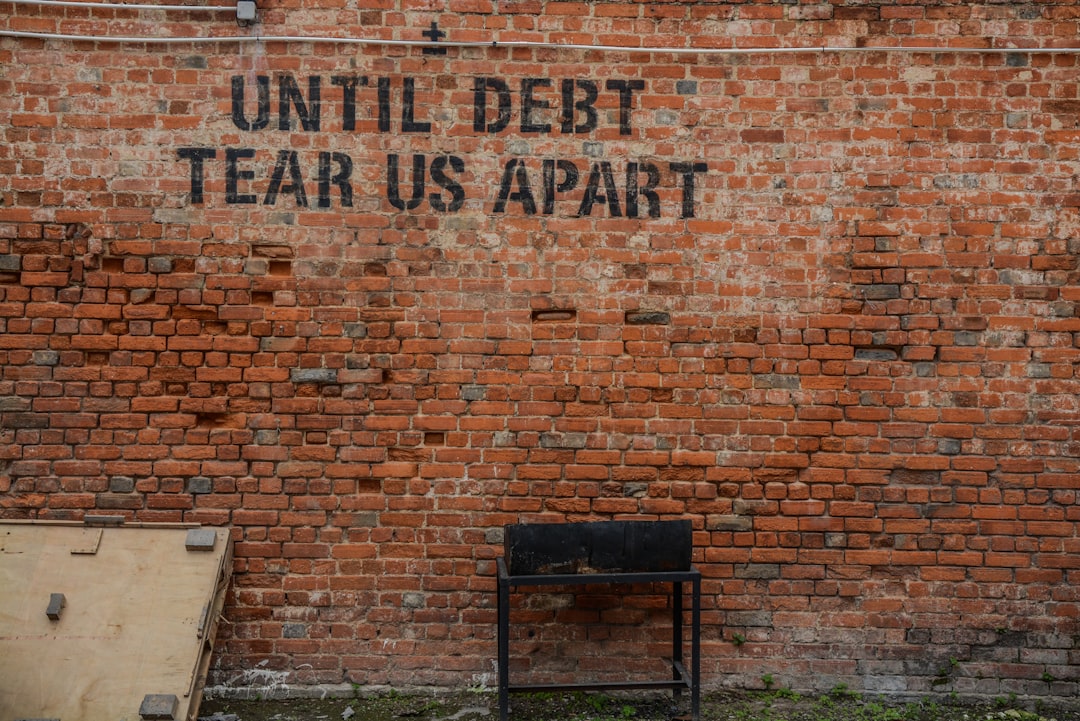

CVR Energy Inc. (CVI), a refinery and fertilizer company listed on the New York Stock Exchange, closed down 6.94% at $22.93 on January 7. Trading volume exceeded 1.66 million shares, surpassing its average. Investors appear to have realized short-term gains and adjusted expectations amid the company’s large-scale debt repayments and its newly announced 2026 investment plan.

## Early Debt Repayment

- As of December 31, 2025, CVR Energy repaid \$75 million of its senior secured term loan (Term Loan A) ahead of schedule via certain subsidiaries.

- The remaining balance on that term loan fell to approximately \$165 million.

- By reducing leverage and interest expenses, the company aims to bolster future cash flows, although the move may be perceived in the short term as prioritizing financial prudence over growth investments.

(See SEC filing¹)

## Early Debt Repayment

- As of December 31, 2025, CVR Energy repaid \$75 million of its senior secured term loan (Term Loan A) ahead of schedule via certain subsidiaries.

- The remaining balance on that term loan fell to approximately \$165 million.

- By reducing leverage and interest expenses, the company aims to bolster future cash flows, although the move may be perceived in the short term as prioritizing financial prudence over growth investments.

(See SEC filing¹)

## 2026 Capital Expenditure Outlook

In the same filing, CVR Energy revealed its 2026 capital expenditure (capex) outlook and began using an updated investor presentation as of January 5. The presentation lays out a blueprint for allocating capital among:

- Maintenance and turnaround spending across refining and fertilizer operations

- Selective growth projects

- Additional debt reduction

Market observers note that the emphasis is squarely on deleveraging rather than expanding capacity for dividends or share repurchases.

(See Investor Presentation²)

## 2026 Capital Expenditure Outlook

In the same filing, CVR Energy revealed its 2026 capital expenditure (capex) outlook and began using an updated investor presentation as of January 5. The presentation lays out a blueprint for allocating capital among:

- Maintenance and turnaround spending across refining and fertilizer operations

- Selective growth projects

- Additional debt reduction

Market observers note that the emphasis is squarely on deleveraging rather than expanding capacity for dividends or share repurchases.

(See Investor Presentation²)

Investor Reaction and Market Interpretation

Some shareholders, expecting more aggressive shareholder returns or expansion projects amid what many view as a late-cycle phase for refining and fertilizer markets, were disappointed by the company’s focus on debt reduction and conservative capex. As a result, momentum-driven buyers moved to sell.

The roughly 6% share price drop is seen less as a signal of deteriorating fundamentals and more as a market adjustment driven by differing interpretations of CVR Energy’s “strengthen the balance sheet” narrative versus short-term stock momentum.

¹

²