Bloom Energy Corporation (BE) Stock Soars on AI Data Center Contracts

Bloom Energy Corporation (BE) shares jumped nearly 10% intraday to $134.07 on December 9, driven by a string of large AI data center power contracts and several upward revisions to price targets. The rally repositioned Bloom Energy as a key beneficiary of the energy‐&‐AI infrastructure theme. Market capitalization rose by about $35.5 billion to approximately $317 billion.

### Key Highlights

- **Price surge:** +10% intraday to $134.07

- **Market cap increase:** +$35.5 billion (≈₩49 trillion)

- **Sector focus:** Distributed power for AI data centers

### Key Highlights

- **Price surge:** +10% intraday to $134.07

- **Market cap increase:** +$35.5 billion (≈₩49 trillion)

- **Sector focus:** Distributed power for AI data centers

Major Orders Fuel the Rally

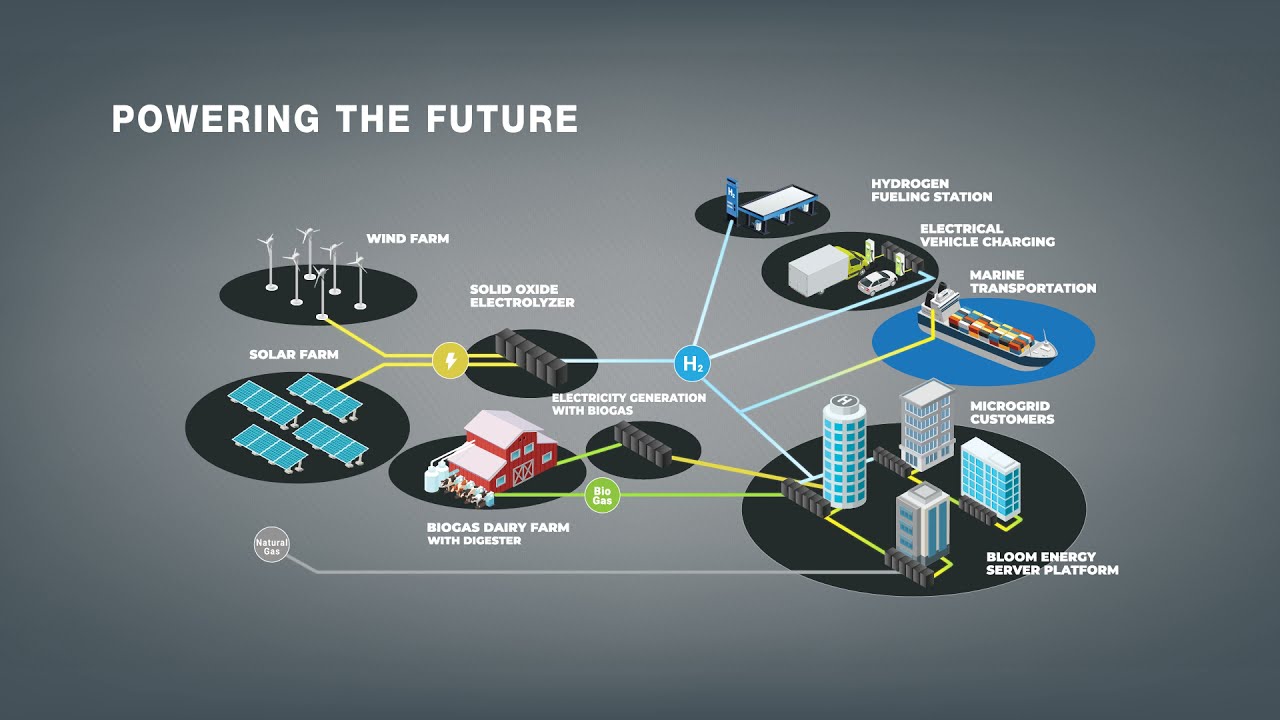

Following last session’s announcement that American Electric Power (AEP) signed a $2.65 billion fuel cell purchase agreement, news of expanded data center investments kept buyers eager. AEP plans to deploy up to 1 GW of Bloom’s solid oxide fuel cells (SOFC) for an off-grid AI data center in Wyoming, illustrating a model that bypasses the traditional grid. Industry observers note this cements Bloom as a “standards candidate” for distributed power in data centers.

Long-Term Growth Story: Brookfield Partnership

In October, Bloom Energy inked a strategic partnership worth up to $5 billion with Brookfield to supply continuous fuel cell power to global AI data centers—or “AI factories.” Together, they are advancing site development in Europe and have already secured supply contracts with Oracle, Equinix and AEP.

---

---

Analyst Reactions

- Clear Street: Raised target from $58 to $68 (+17%), citing potential backlog growth from expanded AI data center demand.

- Other research: Projects multi‐billion-dollar revenue pipeline over the next several years thanks to the AEP deal and Brookfield tie-up.

- Cautionary views: Some maintain a “Hold,” pointing to stretched valuations after the recent run-up.

Risks and Outlook

- Fuel source: Bloom’s fuel cells primarily use natural gas, so they are not a fully carbon-free solution.

- Project complexity: Multi-billion-dollar infrastructure deals remain sensitive to regulatory and permitting hurdles.

Nevertheless, with mounting concerns over AI data center power shortages, fuel cells—offering faster installation and fewer site constraints than traditional plants—are gaining traction as a transitional solution. Bloom Energy is increasingly viewed as a critical variable in the next wave of AI infrastructure investment.