Reasons Behind AlphaTek's 22% Stock Plunge in Just One Day

One-Day Panic Reverses Bullish Narrative

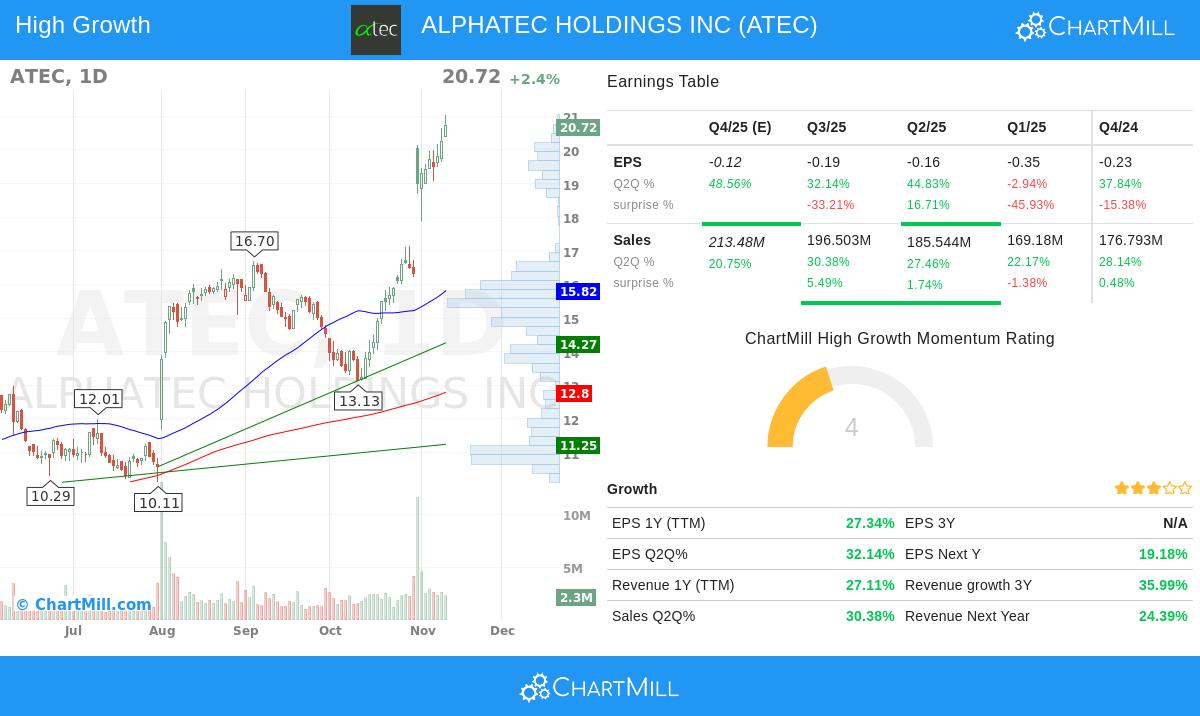

AlphaTec Holdings (ATEC) closed at $17.59 on January 10, plunging 22.34% in a single session. Just days earlier, analysts had lifted its price target into the mid-$16 range on the back of a strong growth story and upbeat outlook. The abrupt slide wiped out roughly $477 million from a market capitalization of about $2.6 billion, leaving investors asking what new adverse development could explain the sudden rush for the exits.

AlphaTec Holdings (ATEC) closed at $17.59 on January 10, plunging 22.34% in a single session. Just days earlier, analysts had lifted its price target into the mid-$16 range on the back of a strong growth story and upbeat outlook. The abrupt slide wiped out roughly $477 million from a market capitalization of about $2.6 billion, leaving investors asking what new adverse development could explain the sudden rush for the exits.

‘Better-Than-Expected’ Reputation Turns Into Burden

Ironically, no clear negative catalyst appeared in the company’s recent announcements. For full-year 2024, AlphaTec reported preliminary results showing:

- Revenue growth of 27% year-over-year

- Surgical revenue up 29%

It then guided for approximately 20% revenue growth in 2025, raising investor expectations . In the first quarter of 2025, the company delivered 22% revenue growth and 24% surgical revenue growth, prompting an upward revision of its full-year guidance . That textbook growth-stock trajectory had already priced in a significant premium, making the stock hypersensitive to the smallest sign of disappointment or risk.

## Growth-Premium Stocks’ Fate: Overreaction to Slight Disappointments

## Growth-Premium Stocks’ Fate: Overreaction to Slight Disappointments

Even the preliminary results for 2025 and the outlook for 2026 maintained a growth trend, but some investors began to fret over a potential slowdown and rising costs. The 2026 outlook projected continued revenue expansion, yet reaching the same acceleration proved challenging after already logging high-teens growth—a classic “base effect” concern . At the same time, reliance on non-GAAP measures—excluding transaction expenses from acquisitions, investment costs and stock-based compensation—stirred doubts about how quickly real profitability could rebound. In other words, the familiar pattern of a growth stock getting overly punished for even a modest deceleration played out in this 22% drop.

Surge in Trading Volume Signals Stop-Loss Selling, Short-Term Volatility Inevitable

Alongside the price collapse, trading volume jumped to 9.43 million shares—well above the norm—indicating that momentum traders and short-term speculators rushed to stop losses. While some institutions and analysts still maintain a “Buy” rating and double-digit growth thesis, the market seems intent on repricing the gap between expectations and reality. All eyes now turn to the official full-year 2024 results and the 2026 guidance update: the company’s ability to convincingly demonstrate sustained growth and improved profitability will determine whether this 22% sell-off proves a simple correction or a structural shift in its valuation framework.